Multi-Strategy Investing with Python and Excel – AllQuant

Original price was: $129.99.$23.00Current price is: $23.00.

Multi-Strategy Investing with Python and Excel – AllQuant Download. We will teach you in-depth on how to create efficient frontiers for both a multi-asset …

Salepage link: At HERE. Archive:

What you’ll learn

- Learn how to install Anaconda and use Jupyter Notebook which is a web-based environment for Python

- Learn how to execute Python codes in Jupyter Notebook

- Learn about variables and data types in Python

- Learn the basic data structures used within Python

- Learn how to import Python libraries

- Learn how to extract data from Internet sources

- Learn how to create the opportunity space and efficient frontier for both a multi-asset and a multi-strategy portfolio

- Learn how to plot and compare the opportunity spaces on the same chart using Python

- Learn how to aggregate performance data from the individual strategies onto the multi-strategy model excel file

- Learn how to track the performance of the multi-strategy portfolio against its component strategies

- Learn how to rebalance across the strategies

- Learn how to operate the multi-strategy file and how it interacts with the individual strategy files

Requirements

- A basic appreciation of computer language and syntax, but not compulsory

- Preferably have completed the Finance Fundamentals for Building an Investment Portfolio course

- Strongly recommended to have completed at least two of our Investment Strategy Quantitative Modeling courses

- For the Excel part of the course, we assume that you have already acquired basic financial knowledge and Excel skills taught in our Investment Strategy Quantitative Modeling courses

Description

Do you know that professional money managers have been generating consistent profits every year using a multi-strategy approach?

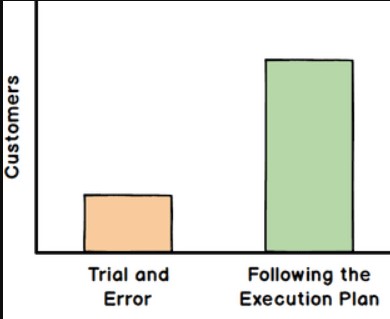

Have you ever wondered why a multi-strategy portfolio is better than a traditional multi-asset portfolio?

THIS COURSE WILL CHANGE YOUR PERCEPTION ABOUT THE APPROACH TO INVESTING.

We will teach you in-depth on how to create efficient frontiers for both a multi-asset portfolio and a multi-strategy portfolio using Python. We will be using a user-friendly web-based integrated development environment (IDE) called Jupyter Notebook. After we have created the efficient frontiers, we will be able to compare them on the same chart and see that the multi-strategy portfolio is far superior to the multi-asset portfolio.

Then you will learn how topull all the strategies taught in the following quantitative investment strategy modeling courses into a multi-strategy approach using MS Excel:

1. All-Weather Investing Via Quantitative Modeling In Excel (Risk Parity)

2. Defensive Stock Investing Via Quantitative Modeling In Excel (Trend Following)

3. Volatility Trading Via Quantitative Modeling In Excel (Volatility Risk Premium)

4. Stock Sector Investing Via Quantitative Modeling In Excel (Sector Rotation)

You will see how you can track the performance of the multi-strategy portfolio, how to allocate capital across your strategies, and when to implement rebalancing.

Note that the details of the individual strategies are not covered in this course. It is highly recommended that you complete at least 2 of the strategy courses, if not all, as they also cover the elementary knowledge behind key investment concepts, financial mathematics, and basic excel skills.

No programming experience is required. Neither do we need expensive tools or data subscriptions. We will use only free resources.

WHAT YOU WILL LEARN

- Learn the basics of Python in a user-friendly web-based IDE called Jupyter Notebook.

- How to use Python to import price data from Internet sources.

- How to calculate annualized return and volatility from price data time series.

- How to create opportunity space and an efficient frontier for both a multi-asset and a multi-strategy portfolio.

- How to plot and compare opportunity spaces on the same chart.

- How to aggregate performance data from the individual strategies onto the multi-strategy model excel file.

- How to track the performance of the multi-strategy portfolio against its component strategies.

- How to rebalance across the strategies.

- How to operate the multi-strategy file and how it interacts with the individual strategy files.

WHAT YOU WILL GET

- Over 5 hours of lectures developed with more than 30 years of experience in the asset management, hedge fund, and banking industry.

- Guided step-by-step model building process complete with templates.

- Fully completed multi-strategy model file that you can use or improve on.

- Unlimited lifetime access.

- Full 30-day money-back guarantee. No questions asked.

- Online Q&A support to address your learning needs.

An investment in the right education is one of the best investments one can make. The earlier you start, the better you will be in the future. So take action now and ENROLL IN THIS COURSE!

Who this course is for:

- Beginner Python developers who are curious about using Python for Quantitative Finance

- Investors who are interested in using Python to create efficient frontiers for their investment portfolios

- Note that this course is conducted in Python 3 for Windows users

- Students from our Investment Strategy Courses who wants to implement a multi-strategy approach using MS Excel

Course content

- Introduction

- Setting Up Jupyter Notebook IDE for Python 3

- Python Basics

- Creating Efficient Frontier for Multi-Asset Portfolio

- Creating Efficient Frontier for Multi-Strategy Portfolio

- Comparing Multi-Asset Portfolio and Multi-Strategy Portfolio

- Introduction To Multi-Strategy Portfolio And Recap of Individual Strategies

- Multi-Strategy Implementation In Excel (2 Strategy Setup)

- Setting Up The Performance Analytics In Excel

- Adding Strategies To The Multi-Strategy Portfolio

- Operations

Here's an overview of the prominent keywords and a list of famous authors:

Business and Sales: Explore business strategies, sales skills, entrepreneurship, and brand-building from authors like Joe Wicks, Jillian Michaels, and Tony Horton.

Sports and Fitness: Enhance athleticism, improve health and fitness with guidance from experts like Shaun T, Kayla Itsines, and Yoga with Adriene.

Personal Development: Develop communication skills, time management, creative thinking, and enhance self-awareness from authors like Gretchen Rubin, Simon Sinek, and Marie Kondo.

Technology and Coding: Learn about artificial intelligence, data analytics, programming, and blockchain technology from thought leaders like Neil deGrasse Tyson, Amy Cuddy, and Malcolm Gladwell.

Lifestyle and Wellness: Discover courses on holistic health, yoga, and healthy living from authors like Elizabeth Gilbert, Bill Nye, and Tracy Anderson.

Art and Creativity: Explore the world of art, creativity, and painting with guidance from renowned artists like Bob Ross and others.

All the courses on WSOlib are led by top authors and experts in their respective fields. Rest assured that the knowledge and skills you acquire are reliable and highly applicable.

User Reviews

Only logged in customers who have purchased this product may leave a review.

Original price was: $129.99.$23.00Current price is: $23.00.

There are no reviews yet.