Optionstrategist – The Expected Return Calculator

$249.00 Original price was: $249.00.$53.00Current price is: $53.00.

Salepage link: At HERE. Archive:

DOWNLOAD INSTANTLY

PLEASE CHECK ALL CONTENTS OF THE COURSE BELOW!

The Expected Return Calculator

The Expected Return Calculator

Get The Expected Return Calculator at the CourseAvai

The Expected Return Calculator

Use statistical analysis to evaluate potential positions

The Expected Return Calculator is McMillan’s proprietary analytical software that uses statistical analysis to evaluate complex option positions, in order to give the trader an idea of whether or not there is a probability of success in a trade.

What is Expected Return?

Expected Return is the return one could expect to make from a position over a large number of trials. Unfortunately, in the real world, each position we invest in has only one result – not a large number of results that we can average.

However, in the long run, if one consistently invests in positions with superior expected returns, then he should show superior returns in his portfolio or trading account. All the facets of a strategy are incorporated into expected return – in particular, the probabilities of making or losing money and the size of profits or losses are both factored in.

Why use the Expected Return Calculator?

The results from The Expected Return Calculator can easily help investors and traders decide whether a particular option position is worth establishing. Furthermore, expected return analysis is the only way that a trader can accurately compare different strategies to see which is best: is a diagonal spread or a covered write the best trade? Or maybe a simple option purchase is best. Expected return can help you decide.

Get The Expected Return Calculator at the CourseAvai

How to use The Expected Return Calculator

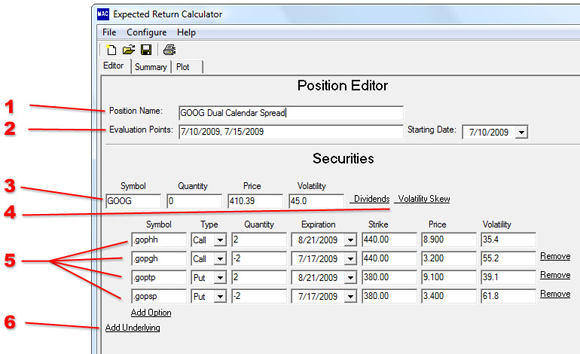

First, the trader defines his position, which can be extremely complex – involving multiple options and expiration dates, as well as a possible linear volatility skew.

- Name the position for your own reference.

- Enter the specific dates you would like to use for your position’s “Evaluation Points” along with the starting date.

- Provide information about the underlying security, including the Symbol, Price, and Historical Volatility.

- Enter any dividend or volatility skew information that pertains to the position you are analyzing.

- Enter the information for each leg of the option position, including Option Symbol, Type (put or call), Quantity, Expiration, Strike Price, Option Price, and Option Implied Volatility (implied volatility can be set to 0 and be automatically calculated).

- Multiple underlying can be incorporated into the position as well by use of the “Add Underlying” button.

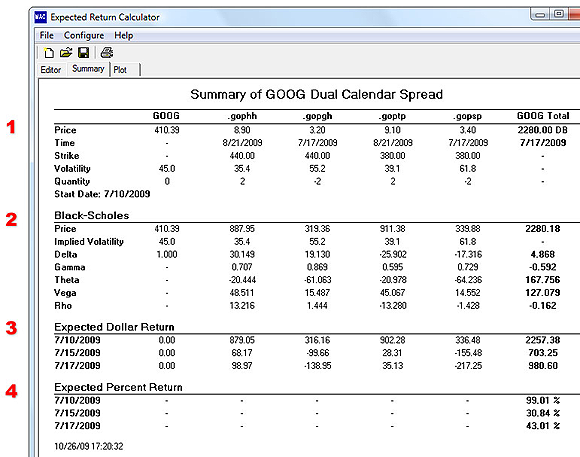

Click the “Summary” tab and outputs are calculated swiftly and accurately, and all can be printed and exported to Excel. Tabular outputs include position “greeks” as well as expected profit calculations at any number of user-defined dates during the life of the position.

- A summary of your inputs is provided.

- The Greeks, including Delta, Gamma, Theta, Vega and Rho are calculated and presented.

- The Expected Dollar Return is shown at each data point for each leg and the entire position.

- The Expected Percentage Return is provided for the entire position at each data point.

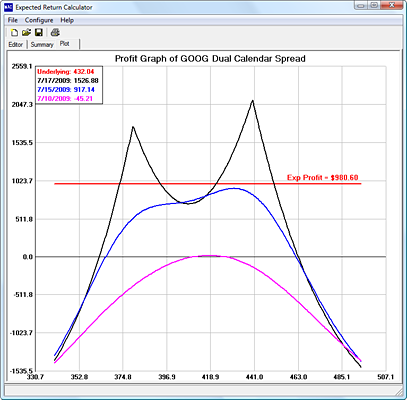

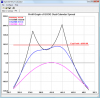

Under the “Plot” tab, graphical outputs show how the position is expected to behave at the user-defined intervals. The Expected Return calculator allows you to easily visualize exactly how much money you’d expect to make or lose at any underlying price and at any time throughout the life of the position.

More about The Expected Return Calculator:

- Analyze complex positions involving multiple options

- Encompasses volatility skews

- Date Calculator functions

- Profit/Loss Graph, including user-defined time lines

- Expected profit clearly marked on profit graph

- Legend on profit graph allows easy identification of important data points

- Tabular display of profit information available as well

- Position “greeks“ are shown

- User-defined commission rates allowed

- Outputs can be exported to Excel

- Save data files to your hard drive

- Print functions available for all outputs – graphic or tabular

- 30-page User Manual included under Help Topics

Get The Expected Return Calculator at the CourseAvai

Here's an overview of the prominent keywords and a list of famous authors:

Business and Sales: Explore business strategies, sales skills, entrepreneurship, and brand-building from authors like Joe Wicks, Jillian Michaels, and Tony Horton.

Sports and Fitness: Enhance athleticism, improve health and fitness with guidance from experts like Shaun T, Kayla Itsines, and Yoga with Adriene.

Personal Development: Develop communication skills, time management, creative thinking, and enhance self-awareness from authors like Gretchen Rubin, Simon Sinek, and Marie Kondo.

Technology and Coding: Learn about artificial intelligence, data analytics, programming, and blockchain technology from thought leaders like Neil deGrasse Tyson, Amy Cuddy, and Malcolm Gladwell.

Lifestyle and Wellness: Discover courses on holistic health, yoga, and healthy living from authors like Elizabeth Gilbert, Bill Nye, and Tracy Anderson.

Art and Creativity: Explore the world of art, creativity, and painting with guidance from renowned artists like Bob Ross and others.

All the courses on WSOlib are led by top authors and experts in their respective fields. Rest assured that the knowledge and skills you acquire are reliable and highly applicable.

Specification: Optionstrategist – The Expected Return Calculator

|

User Reviews

Only logged in customers who have purchased this product may leave a review.

$249.00 Original price was: $249.00.$53.00Current price is: $53.00.

Related Products

Logical Price Action: The Complete Course – Feibel Trading

Total Fibonacci Trading – TradeSmart University

Signature Trade – Forexia

LT Indicators (Pulse, Gamma, Ultra, Trend) (May 2013) – Metatrader

Simple Setups For Consistent Profits – Base Camp Trading

$249.00 Original price was: $249.00.$53.00Current price is: $53.00.

There are no reviews yet.